The Increasing Impact of Finance on S&OP

Each year around this time, leaders and managers across all functions are looking ahead to next year. They are thinking… What do I need/want my group to accomplish? How many people should I have? What is this going to cost? How can I justify it? How am I going to work-in, perhaps negotiate the mandated cuts and improvements?

Yep – revenue and cost quantification, justification, negotiation, and approval. Not so easy.

Finance is usually running around spearheading the budget effort. They are trying to collect things in uniform format so it can be rolled-up, struggling to get people to input data correctly in the associated IT system, and in some cases, hounding managers who are late on their inputs. All of this knowing they’ll be working on a few iterations as the back-and-forth between top-down and bottom-up plays out.

There’s a better way. Through tighter financial integration with S&OP, companies are lessening the pain of the budgeting process. With a forward rolling plan, managers have been thinking about next year’s requirements already and have been getting consensus approval through the confirmation of the monthly S&OP plan. It’s like doing the budget a little each month. Finance has a sound place to build from for the next “real” budget. Certainly the planning months connected with the budget cycle are a little more rigorous than the other months because unlike a rolling S&OP forecast, the budget is the budget, and as we know it doesn’t change. Leaders get stuck with it and measured against it for a year.

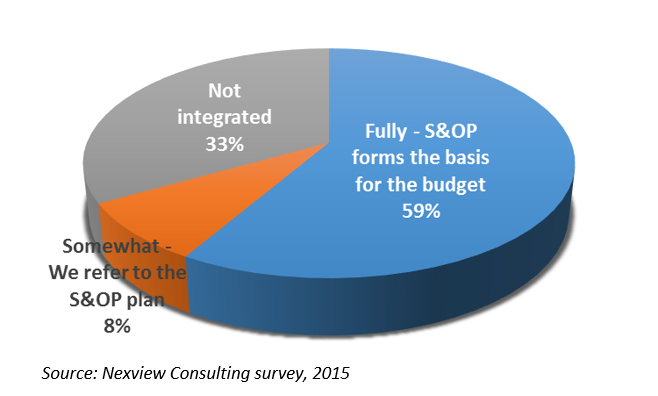

A recent study shows that 59% of companies surveyed have integrated the budgeting process right in with S&OP. I think this number is a little on the high side with respect to the general population, but that’s what this cross-industry survey showed. If your company isn’t yet part of the blue team shown in the figure below, here are a few suggestions to improve financial integration.

Figure 1. Companies Integrating Budgeting with S&OP

Elevate the role of Finance in S&OP

The nuts and bolts. S&OP obviously isn’t Finance’s primary role and in many organizations the integration is still developing, so they may need some big picture S&OP coaching in addition to clarifying their role. The first step is to get them to monetize S&OP plans. This isn’t always a slam dunk especially to automate the report views at the aggregate level for the various S&OP component meetings. All participating S&OP functional leaders need monetized plans to run their respective areas. Additionally, it’s important that the S&OP design be synchronized with the way the company financially manages and reports. You’d be surprised how often this is not aligned with the S&OP design. Finance can have a voice if the S&OP design should be tweaked or can be involved if the financial reporting structure should change.

The wrench to tighten the nuts and bolts. Finance has the best overall view of how financial plans come together, thus they have much to add when resolving cross-functional business issues. Plus, they are impartial and from my experience, a pretty rational bunch. It’s not their role to sell or execute (operationally anyway) and their incentives aren’t geared along functional lines. Why wouldn’t you want them to have a key role? Finance team members can not only be good arbitrators, but also are the anchor to the budget. I don’t mean in the sense of delivering it, but they know it cold across the company and what went into it. They can lead budget variance discussions, ask important questions, and be a voice of reason when needed. Another way to build on the nuts and bolts described above is by seeking their assistance and leadership in scenario evaluation and the associated financial implications. This is an important step on the S&OP maturity journey.

Power tools to turbocharge S&OP effectiveness. To really propel S&OP and finance’s role in it, CFO (or senior finance leader) involvement is essential. CFO’s are becoming more operational these days, many are wearing more hats. I find that finance teams have become more stretched in recent years (along with other G&A functions), and to get the response and enthusiasm from an already busy group, you’re going to need their chief. If you need to convince your CFO of this worthy endeavor, in addition to the budget-related items I’ve mentioned, point to some lagging KPIs and existing budget variances and describe how S&OP could have changed these outcomes.

Without strong finance involvement in S&OP, it’s unlikely the budgeting process will be integrated with S&OP and will start from a common plan. You’ll be in for the same disruptive fire drill each year described at the beginning of the article. Next to your sponsor, the CFO can be the most important factor in a successful executive S&OP. (BTW – CFO’s can be great sponsors too!)

So there’s a few ideas to elevate finance’s role in S&OP and to get better budget integration with the process. Finance will continue to have an increasing impact in best practice S&OP. Help them do it, and good luck this budget season!