Improving the Supply Chain “Front End” – Supply Chain New Year’s Resolutions, Part 1 of 3

Now is a time that many of us are beginning improvement initiatives, a time full of new aspirations and starts. Several have had wheels in motion at the end of last year in the form of generating ideas, building consensus, securing budgets, and even conducting assessments. If you’re not out in front of it yet, you still have time…, it’s a long year…, and it’s just beginning, right? Well – that’s true for a little while, but we all know what happens with time. Your competitors and the highest achievers in your company are already on it, better not wait too much longer.

So where is the biggest bang for the buck? That depends. This post will be the first of a 3 part series discussing areas throughout the supply chain that are often ripe for improvement opportunities. I’ll split them up in the categories of “Front”, “Middle”, and “End” to match the corresponding parts of the supply chain. I’ll release the posts a little more frequently than normal to try to keep current with the New Year’s resolution theme, but will also ask for a little slack if I mention a New Year’s resolution in several weeks. Some suggestions will be familiar, perhaps some will also have been a thorn for a while, but overall I hope that my suggestions will jog some thoughts. I’ll continue to release more on these subjects as time goes on and please check Nexview Online for multimedia content that is more in depth on the topics to come.

Opportunities in the “Front End” of the supply chain

Customer Management

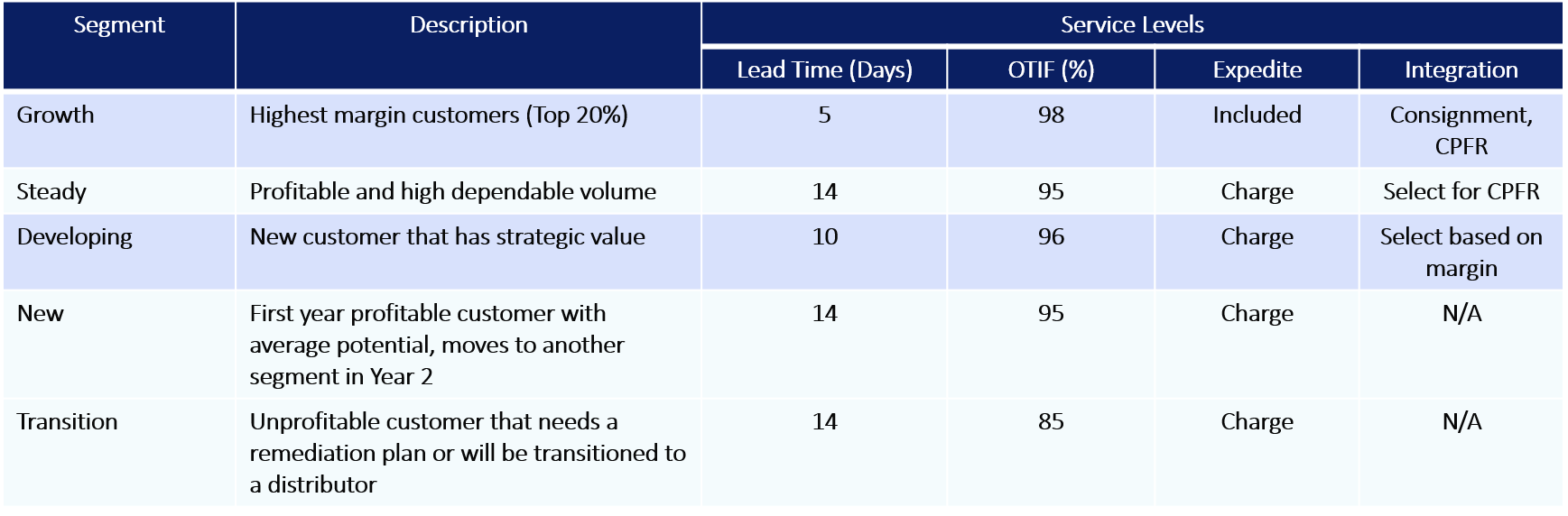

For this large topic, I’ll stick to a few points on segmentation. First, let’s be clear. Anyone who’s ever tried to develop or grow a business knows how hard revenue generation is. Countless hours that yield nothing in exchange for the few that do hit. So for those who haven’t done this, please don’t be so quick to “segment away” business from the rainmakers by pushing for overly restrictive policies. Having said that, there’s a balance here, the tilt of which depends upon where you are as a company and your positioning in the marketplace. Segments are essential and need to dictate downstream service levels in complex businesses, otherwise you’ll be/become uncompetitive.

Segments are often determined by factors such as revenue, profitability, growth potential, revenue predictability/risk, level of customer integration, products purchased and customer/supplier power balance. (Supplier power is rare, but some companies actually have this, must be nice.) Geography is becoming more obsolete as a segmenting factor with globalization, but maybe it makes sense for your situation. Channel is another possibility. There should also be a relationship between your customer segments and the way the commercial organization faces the marketplace (i.e. org structure and even perhaps P&L). Customers will also often belong to more than one segment for some parts of the business, but it’s generally best to categorize them where the bulk of the business is rather than try to split pieces of the customer business across multiple segments.

Over time all of these dynamics change and all these relationships need to be reviewed holistically, perhaps once/year with major integrative change every few years.

Supply chain service levels can then be set according to segment. I’m talking about things like lead time, inventory levels/order-fill rate, MTO vs. MTS, level of supply chain integration (e.g. VMI, consignment, CPFR, alliance, IT integration for transactions). These things must be matched to each segment, otherwise you’re just reacting to demand from anywhere, likely with more cost than competitors. It doesn’t have to be perfect, but it has to be something.

A segmentation effort takes a business and operating strategy and data to create and back up the segmentation rationale. Implementation takes change management, communication, consensus, sponsorship, metrics, and a calculated tolerance for the repercussions (i.e. customer dissatisfaction/loss). None of this is easy and typically doesn’t get worked into someone’s “spare time”. It’ll take executive involvement to get consensus and compliance.

In the end, segment definition and associated service levels is a guideline. Business decisions and special circumstances will happen and that may produce exceptions (which need to be tracked for segmentation sustainability). A lack of defined segments and associated service levels often shows up as a root causes of savings areas I’ll discuss throughout this series.

Table 1 – Summarize Your Segment Definition for Easy Communication (Example)

Product Portfolio Management

This area is often as sensitive in the organization as customer segmentation. New products for more sales, and a trimmed portfolio to reduce waste and make room for the new are obviously the goals. To reduce the cycle time of new product introduction (i.e. increased revenue), it’s important to have a defined stage gate process that includes decision criteria around items such as technical performance, feasibility, competition, market opportunity, pricing, demand, regulatory issues, capital investment, and portfolio impact among other items. The process at each step culminates with the gate criteria and cycle time is measured for each step with the continuous goal of reducing it for entry into the supply chain and market.

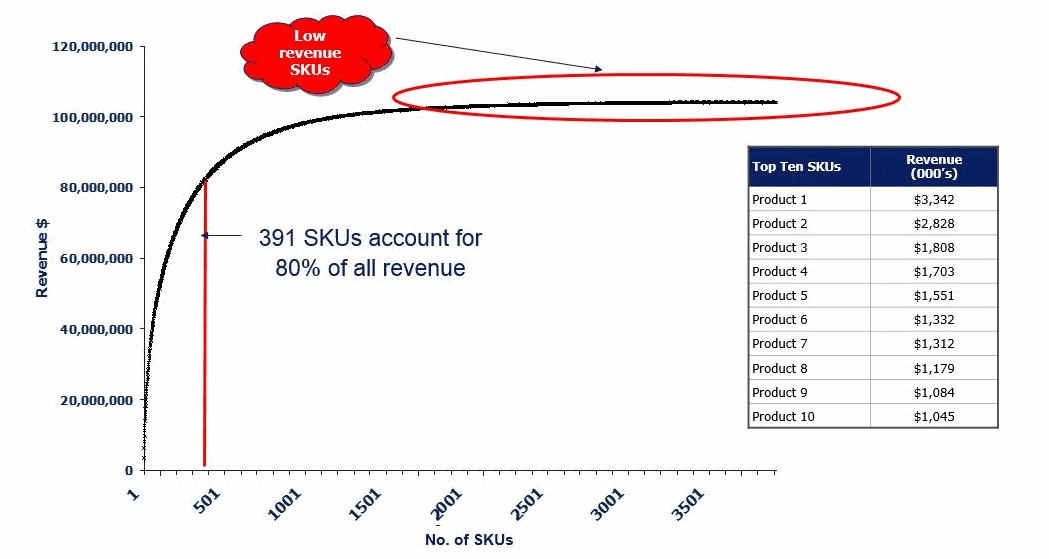

The other side of course is trimming the portfolio on an on-going basis and this involves revenue and profitability at the product level vs. complexity/cost in the supply chain and G&A, as well as whether new products can offset overhead absorption lost by retiring products. A good place to start is by completing a Pareto analysis that shows a build-up of revenue and profitability by product. You’ll usually find that 80%+ of revenue and/or profitability comes from 20% or less of the products. You can then start to attach criteria to the rest of the portfolio to help decide their fate.

It helps if the processes above are embedded into the culture, thus considered “normal”. It also helps if this is mechanized through the monthly Sales & Operations Planning process (i.e. Portfolio Review meeting). If it’s not, and done on an “as-needed” (haphazard) basis, it’ll either not be done or it will be a fight every time.

Figure 1. Cumulative Revenue by SKU Shows Most Revenue is Derived from a Small Set of Products (Example)

Demand Management

We know demand management is a work-in-progress for most companies as they try to get better at assembling the various demand signals from around the marketplace and achieve a cross-functional consensus. This of course is balanced with the budget commitments that were made and the demand shaping (promotions) activity that the company decides upon. Improving demand management is a continual cycle of process improvement –> measuring/analysis –> process improvement. You don’t have to be perfect, just better than the competition.

The process improvements often involve projections based on historical data (e.g. statistical analysis of sales, POS data), how sales and marketing provide input (level in the product hierarchy, horizon), how macroeconomic and event factors are included, and how real time data (e.g. orders) are used to influence what is actually supplied in the near-term (demand sensing). Similar to any process, accountability definition is important. I recommend that the accountability for the process rest with demand management, and the results of the process (i.e. metrics) rest with sales.

The measuring part usually involves flavors of the forecast error metric (product/family level, by customer, by salesperson, and/or by demand input) as well as the management system for managing. A good demand consensus process includes everything we’re talking about here.

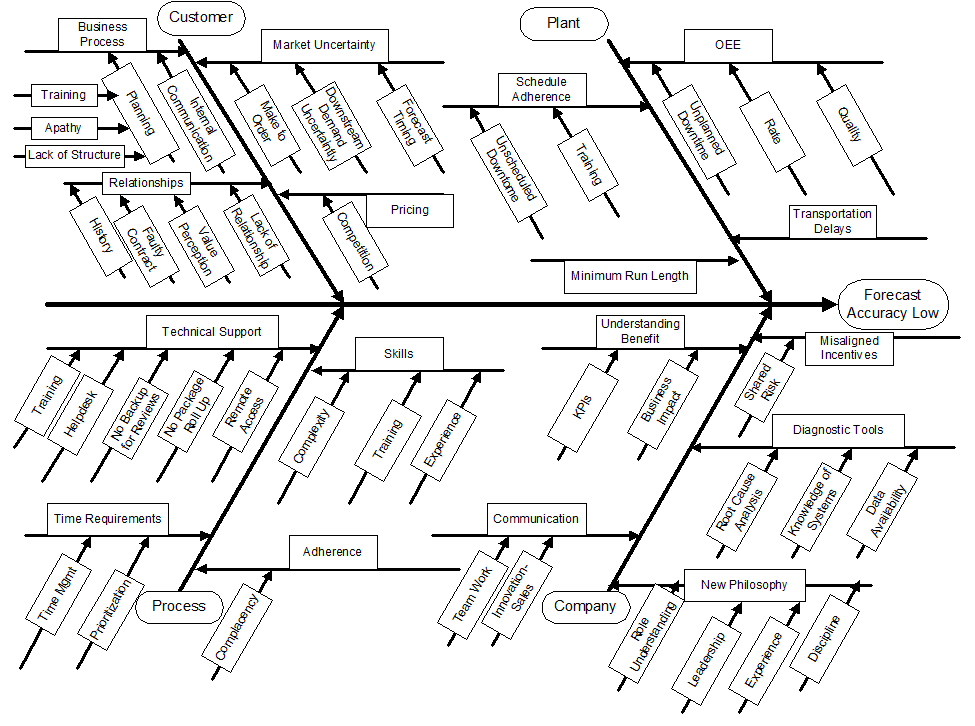

Figure 2. A Fishbone Diagram Can Be Used to Determine the Root Causes of Low Forecast Accuracy (Example)

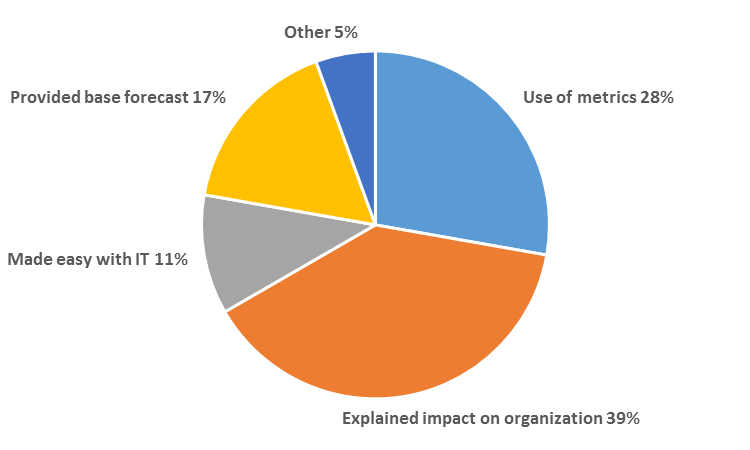

Figure 3. Ways That Are Most Effective for Engaging Sales in Demand Planning

Source: Nexview survey, 2015

Well there’s a few ideas for the “Front End” of the supply chain. In the next post we’ll cover a few points for what we’ll call the “Middle” of the supply chain. We’ll talk about a few points regarding potential improvement opportunities in production planning & scheduling, inventory management, and procurement.

Get all our tips on supply chain results areas and methods to manage now

For a concise guide on ideas for achieving supply chain improvements and managing results-oriented change programs, see the new book Sales & Operations Planning RESULTS – Find, Measure, and Manage Results Throughout Your Supply Chain, available in paperback and Kindle formats on Amazon.