Improving the “Middle” of the Supply Chain – Production Planning & Scheduling

The year is moving on and if you haven’t started your improvement initiative yet, you should gear up now to enable sufficient time to make a sustainable impact this year. I’m publishing a series of posts/articles this year on making improvements throughout the supply chain and I’m just moving through it in a front to back fashion. In the last article, I discussed some suggestions for improving the “front end” of the supply chain (Customer Management, Product Portfolio Management, Demand Management). Over the next few articles, I’ll provide a few suggestions to improve the “middle” of the supply chain. For the “middle”, I’m including production planning & scheduling, inventory management, and procurement. I’ll stick to production planning & scheduling and the related areas of monetary impact in this one.

Like demand planning, planning & scheduling are enabler processes that sometimes need improvement to enable monetary benefits and improvements in operating metrics. Planning usually refers to a longer term horizon (should be the S&OP horizon) while scheduling is much more tactical (this week, this month). We normally start with process reviews to gain an understanding of how demand transitions to longer term supply planning and shorter term production scheduling. We review how lines are scheduled and sequenced, how on-hand inventory is netted to determine a production requirement and how raw material requirements are determined (aka the MRP process). We also look at how production orders are prioritized. Gaps here can show up as things like:

- Inconsistent line loadings

- Unplanned/excessive changeovers

- Lack of defined sequencing

- Lack of an effective product wheel with minimum and desired run lengths and that balance transition costs with inventory carrying costs (process industries)

- Lack of a way to correct for short-term demand signals (demand sensing)

- Breaking the schedule for a variety of reasons (see below)

- Production delays due to lack of raw materials (often we need to start tracking this manually)

- Gaps in the hand-off of the schedule from production scheduling to operations

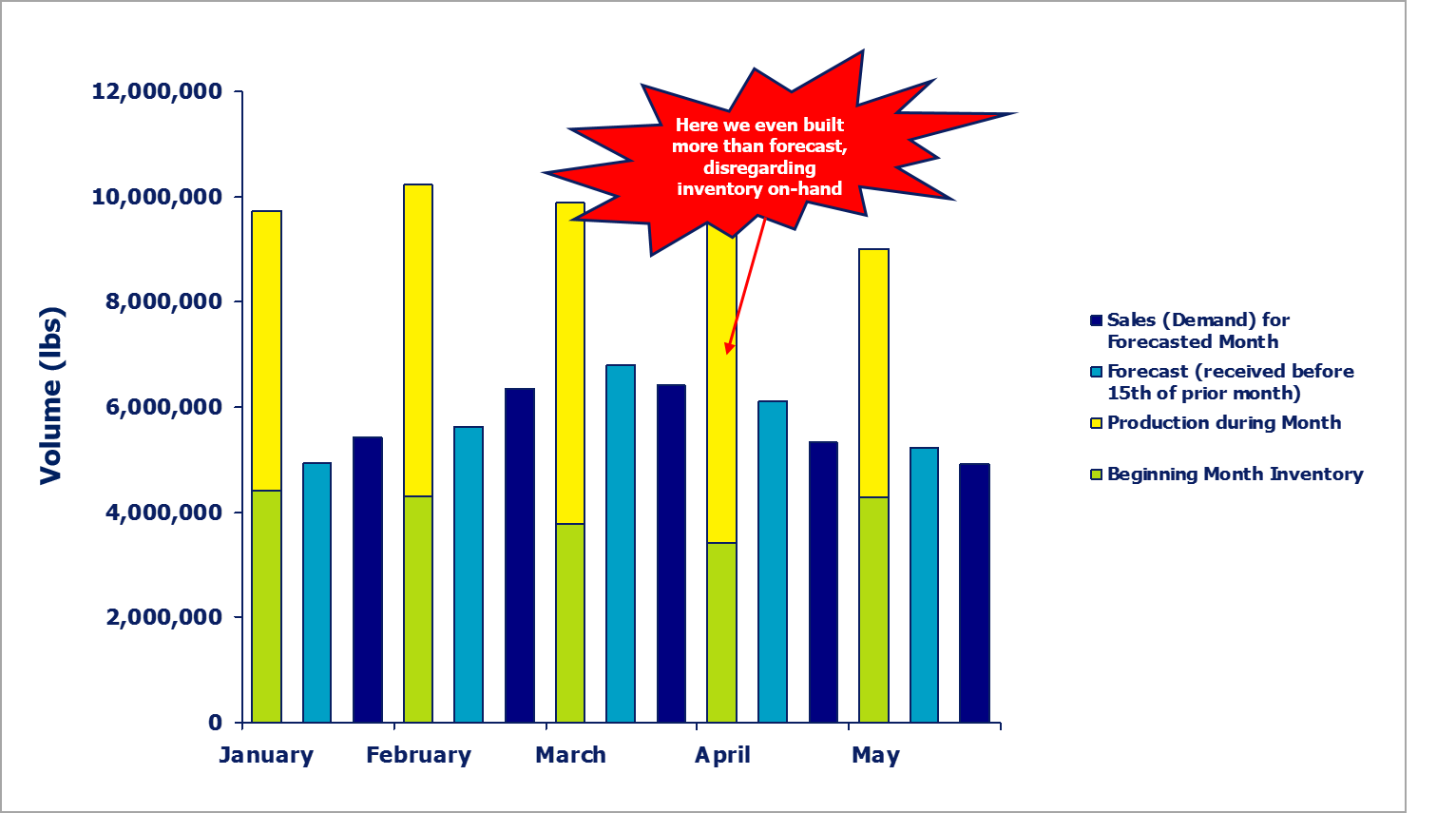

It’s important that a formal meeting exist (often weekly) for operations to take ownership and commit to the schedule. If the company doesn’t have a strong S&OP process, production can get out of synch with demand and current inventory levels as shown in the chart below.

Figure 1. Production Doesn’t Always Align with Demand and Inventory Levels

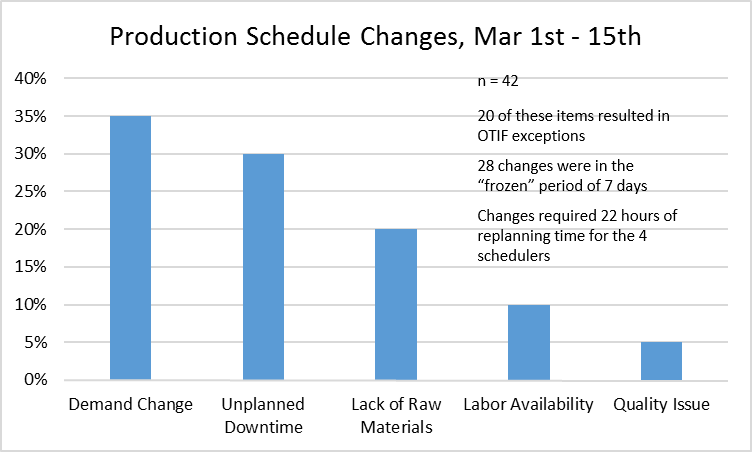

Right away we’ll start tracking and reason coding production schedule changes and while this isn’t usually a gap in the scheduling process itself, it points to gaps in interfacing areas. It is a good study to complete to show how many changes are occurring, where changes are coming from, and what the associated impact is. Production scheduling has the burden of tracking changes and making reason codes visible such that root causes (e.g. commercial driven or plant reliability) can be addressed.

Figure 2. Reasons for Production Schedule Changes

Most companies have issues with production time fences (they either don’t have them or don’t respect them), and the costs of changes that occur within time fences usually aren’t quantified. Following a production schedule and production order change through can show wastes in overtime, rework (lost throughput), material usage, quality, and expedited shipping. It’s also interesting to show for which customers changes are made to see if they are “C” customers. It’s very common for companies to jump through a bunch of hoops for a marginal customer.

We look for up-to-date master data (e.g. asset capacities, routings, and bills of materials). Most companies have gaps here and master data maintenance like any other process needs accountabilities, frequencies, and steps associated with it. Gaps here can result in over or under committing (potentially lost sales), overtime, and material usage as well as adversely impacting operating metrics such as schedule adherence and OTIF. Repeated variances between standards and actuals may point to gaps in master data (beware though, inefficiency could also be in the variances).

A defined strategy for make-to-order vs. make-to-forecast by SKU is also required and can tie to inventory, premium freight, overtime, and inventory benefits. The drivers here are required lead time demanded by the market (shorter lead times driving the need to make to forecast) as well as changeover/transition effort, production schedule stability considerations, and the degree of product customization required.

Well there’s a few thoughts on production planning & scheduling. In the next post, we’ll take a look at inventory management and some tips for getting this popular area under better control.

Get all our tips on supply chain results areas and methods to manage now

For a concise guide on ideas for achieving supply chain improvements and managing results-oriented change programs, see my new book Sales & Operations Planning RESULTS – Find, Measure, and Manage Results Throughout Your Supply Chain, available for members to download or available in paperback and kindle formats on Amazon.