Does Your S&OP Process Need Portfolio Review?

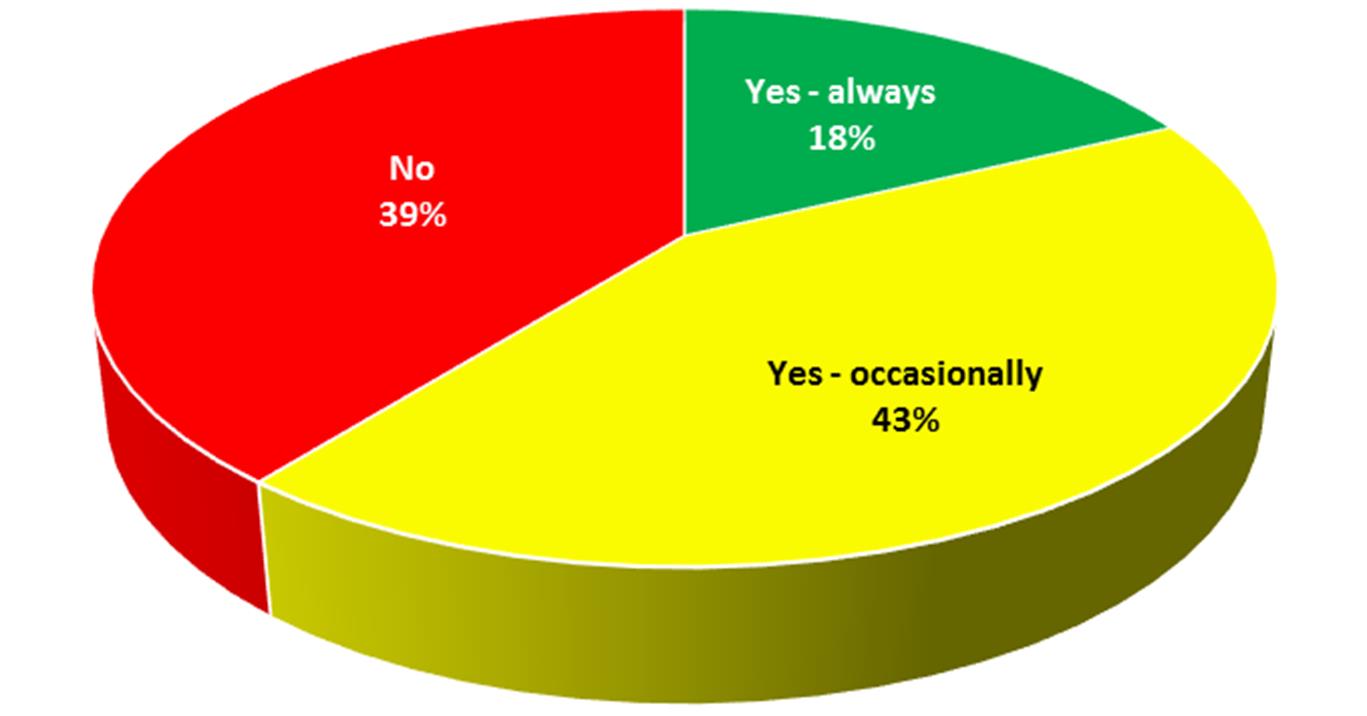

While most developed companies have implemented some form of an S&OP process, many have yet to include the Portfolio Review component as part of their regular monthly meeting cadence (e.g. Demand Review, Supply Review, Pre-S&OP, Executive S&OP). As S&OP has evolved to integrate more functions of the company, Portfolio Review has been one of the growth areas in recent years. Our 2017 Key Topics in S&OP survey indicates that Portfolio Review is still a developing area for S&OP and likely for many companies as shown in Figure 1.

Figure 1. Companies Were Asked: Do you have a Portfolio Review with each S&OP cycle?

Source: Nexview Consulting Key Topics in S&OP Survey, 2017

When we work with a company on their S&OP process, we never assume that the process needs prescribed S&OP meeting components. While “best practices” are out there, “best” is not always best for everyone. Thus, we design the process for each individual application. Sometimes that means a Portfolio Review is included, sometimes not.

What is Portfolio Review anyway?

Portfolio Review is a dedicated S&OP component meeting that at a minimum:

- Reviews the Product Portfolio as a whole – This includes new products coming in, old ones phasing out (or should phase out), and confirmation that the products/product lines work together and align with strategy.

- Reviews product profitability to support portfolio decisions

- Confirms demand, and reviews revenue and profit for new products – Demand agreement for new products then gets included in the regular Demand Review for all products.

- Integration with operations functions to plan introduction and ramp-up

- Related KPI management

There are several other topics that companies can include, but these are the basics. I’ll write more about Portfolio Review topics in a future post (see below).

The Portfolio Review meeting is usually sponsored by a marketing vice president and facilitated by a product manager (who may call upon other product managers to discuss their areas as relevant). Other participants can include engineering, finance, operations, and demand management. The participant roles can be somewhat fluid depending upon the agenda (including specific product managers as needed). Also – the agenda itself can be fluid, maybe the portfolio review part doesn’t have to be done each month, but the new product introduction and KPI review parts do. It can vary depending upon planning and decision needs.

Great – So which companies need this and which do not?

The answer is a favorite among consultants, which is, it depends! I usually recommend Portfolio Review for companies with a large number of SKUs (hundreds). That’s not to say if you have less than 100 products, you shouldn’t look at your portfolio, but maybe you don’t need this every month as part of S&OP. S&OP is hard enough for many companies to pull off each month and I never suggest adding meetings and reports where we don’t need them. If your portfolio is not that dynamic, maybe this can be done quarterly, or with less formality. Note that most respondents in our survey have Portfolio Review “occasionally”, although processes for some of them are likely more informal as opposed to operating at a designed frequency. Some S&OP “experts” would vehemently disagree with me and say everybody needs Portfolio all the time, but I suggest fit-for-purpose is always the best approach.

For companies that don’t have a good handle on their product life cycle/management process, formalizing Portfolio Review can help a great deal. A weak stage gate process, little visibility or review of product profitability, surprise demand for new products, and inability to sunset products from the portfolio are all very common problems. People become emotional about their products, and logic and good communication does not always prevail. If you’re in this camp, even if your portfolio isn’t too big, an objective Portfolio Review and a visible KPI or two is just what the doctor might order to cure a case of emotional attachment to products that are actually dogs, or to cure communication shortfalls for new product introductions across functions.

The must-have case for Portfolio Review is for companies that have large, dynamic product portfolios (SKUs numbering in the several hundreds, thousands, or even tens of thousands). Imagine what a mess we’d have if we had no air traffic controllers and pilots could fly anywhere they wanted to. All those planes in the air or products in the marketplace need some structured coordination. In my experience, consumer products and high tech companies with short product cycles have the most developed Portfolio Reviews (and underlying product management processes too).

Want to see more about what companies are doing in Portfolio Review?

We’ll write about this in a future post, but for now please see a survey response chart of what companies are doing in Portfolio Review and best in your efforts to integrate product management processes with the rest of the company! Please also see the post from my colleagues at Vanguard Software on how advanced-analytic forecasting and planning can help drive Portfolio Review, and your entire S&OP process.